UK-China Transition Finance Workstream Launched with Inaugural Seminar Held in London

At the 11th UK-China Economic and Financial Dialogue (EFD) held in January 2025, the two governments expressed their commitment to further strengthening cooperation in the field of green finance and proposed the establishment of two new thematic workstreams focusing on transition finance and nature and biodiversity finance. To implement the policy outcomes of the EFD, the 7th meeting of the UK-China Green Finance Taskforce (GFT) and a series of side events were successfully held during London Climate Action Week. At the plenary meeting on June 25, 2025, Dr. MA Jun, Co-Chair of the UK-China Green Finance Taskforce, Chairman of China Green Finance Committee, President of Institute of Finance and Sustainability (IFS), and Sir Charles Bowman, Co-Chair of the UK-China Green Finance Taskforce, former Lord Mayor of the City of London, officially announced the launch of the two thematic Workstreams on transition finance and nature and biodiversity finance. During this meeting, the co-chairs of GFT approved the Terms of Reference (ToR) for the UK-China Transition Finance Workstream, and HSBC, Bank of Communications, and the Institute of Financeand Sustainability (IFS) briefed on the Workstream’s progress and work plan.

The UK-China Transition Finance Workstream is currently co-led by Bank of Communications and HSBC, with IFS serving as the Secretariat, and the China Climate Engagement Initiative (CCEI) acting as a strategic partner. The Workstream comprises around 20 member institutions of major financial institutions. Its objective is to promote the development of transition finance in both countries and strengthen bilateral cooperation, with the aim of scaling up transition financing to support climate goals. The Workstream focuses on advancing mutual recognition and alignment of policy standards, promoting innovation in transition finance products and market mechanisms, and enhancing knowledge exchange and capacity building through practical collaboration.

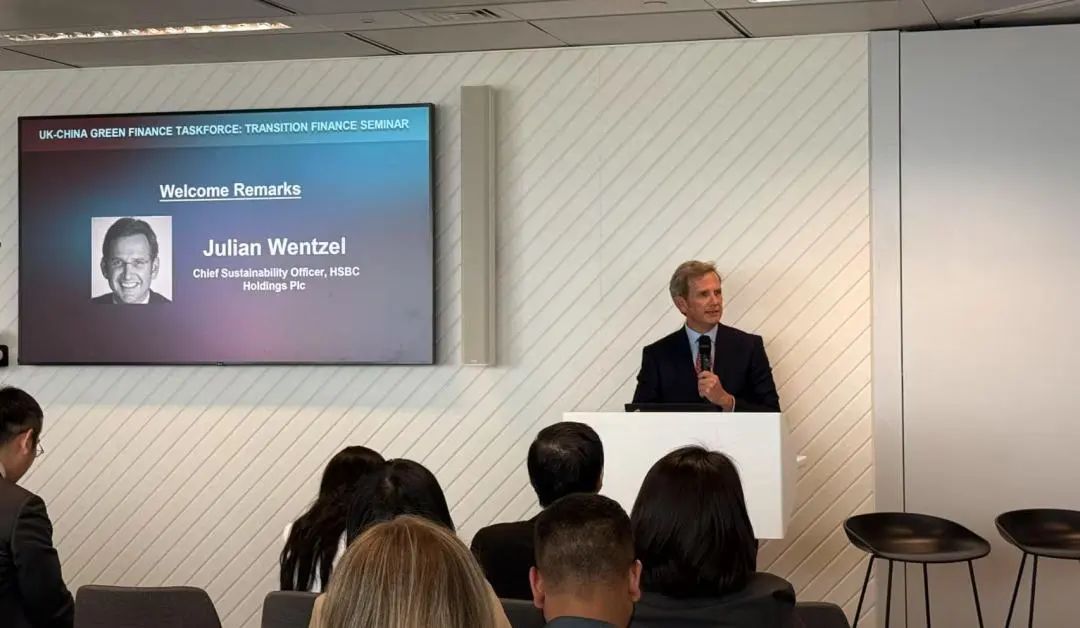

On the afternoon of June 25, the UK-China Transition Finance Workstream held its inaugural seminar at HSBC's headquarters. The event was co-hosted by HSBC, the City of London Corporation, and the Institute of Finance and Sustainability. It brought together around 60 participants, including officials from the British Embassy in China and the UK Transition Plan Taskforce, as well as professionals from major financial institutions in both countries, and experts from international organizations and research consultancies. Attendees engaged in in-depth discussions and exchanges on topics such as transition finance policy standards, product innovation, and cross-border cooperation.

The event was moderated by ZHAO Lijian, Director of the Institute of Finance and Sustainability (IFS) and Head of the Secretariat for the UK-China Transition Finance Workstream.

Julian Wentzel, Chief Sustainability Officer(CSO)at HSBC Holdings Plc, highlighted in his opening remarks that amid the accelerating global shift in energy structures, transition finance plays a critical role not only in tackling climate change, but also in maintaining financial system stability and unlocking new business opportunities. He noted that both a range of existing and emerging such as AI data centers are rapidly driving up energy demand. The only sustainable way to meet this “incremental energy demand,” he argued, is to accelerate the development and integration of zero carbon energy generation, while also expediting the net-zero transition of high-carbon industries and enhancing energy efficiency. He called for closer UK-China collaboration on aligning transition finance standards and innovating product mechanisms, in order to channel capital more swiftly and effectively into key segments of the transition. He emphasized that the window for meaningful action is narrowing fast, and what truly matters is whether we act today.

Dr. MA Jun, Chairman of the China Green Finance Committee, President of IFS, and Co-Chair of the UK-China Green Finance Taskforce, provided a comprehensive overview of China’s progress under the G20 framework of the “Five Pillars of Transition Finance.” These include taxonomy development, disclosure, financial instruments, just transition, and incentives. He emphasized the emerging model of "central coordination, local experimentation," with over 20 local governments in China having issued regional transition taxonomies. Using Huzhou as a case, he demonstrated how local authorities are offering free carbon accounting and transition templates to SMEs to reduce the cost of due diligence for banks. Dr. Ma urged both countries to strengthen alignment on taxonomies, carbon accounting, disclosure frameworks, and transition pathway design.

![]()

Ana Nishnianidze, Director of Trade & Investment for Innovation & Growth at the City of London, stated in her remarks that the City of London remains committed to serving as a global platform and hub to advance climate finance. She emphasized the long-standing foundation and strong potential for UK-China collaboration in green finance. She noted the urgent need to enhance cross-border connectivity of disclosure data, promote collaborative sharing of capacity-building resources, and establish mechanisms to move from high-level dialogue to on-the-ground implementation. Nishnianidze also commended the achievements of China’s local government pilots, and expressed hope that more pilot initiatives will align with and connect to the UK market in the future.

The co-lead institutions of the UK-China Transition Finance Workstream—HSBC on the UK side and Bank of Communications on the China side—respectively shared updates on the policy landscape and development trends in transition finance in both countries, as well as insights from their institutional practices, including opportunities and challenges. They also outlined key priorities for the Workstream’s next phase.

Tim Lord, UK Head of Climate & Energy at HSBC, representing the UK co-lead institution, shared the UK’s recent national policy landscape and practical approaches to driving decarbonization of hard-to-abate sectors. He noted that while significant progress has been made in the transformation of the UK’s power system, there is a significant challenge in accelerating decarbonization across the economy – for example in the deep transition of industry, manufacturing, and SMEs. He emphasized the importance of joint UK-China efforts to advance standardization of financial products and clarify “investment-grade” transition pathways, in order to facilitate more efficient capital allocation to support industrial transformation.

Fan Shen, General Manager of the Credit Management Department at the Bank of Communications, provided a comprehensive overview of the bank’s recent efforts in advancing transition finance. He noted that the Bank of Communications led the development of China’s first local transition finance taxonomy for the waterborne transport sector and facilitated the issuance of the country’s first transition loan for the shipping industry in Shanghai. Building on this, the bank has extended transition loans to additional sectors including steel, agriculture, and coal-fired power, while actively exploring supporting measures such as carbon accounting and incentive mechanisms. He suggested that the UK-China Transition Finance Working Group could deepen collaboration in areas such as sectoral standards, transition instruments, just transition KPI design, and capacity building.

Vanessa Havard-Williams OBE, Chair of the Transition Finance Market Review, Transition Finance Council of the City of London, delivered a keynote speech introducing the background and key focus areas of the UK's Transition Finance Market Review. She noted that while the financial system has given considerable attention to green assets, there is still a lack of structural support for the transition of high-carbon sectors. She emphasized that relying solely on pressure from financial institutions or corporate disclosure is insufficient to achieve a systemic transition—policymakers must provide clear and actionable transition pathway designs. She recommended that the UK and China build shared understanding at the sectoral level, promote cross-border policy alignment, and jointly develop high-quality transition tools, in order to establish a transition finance framework centered on the real economy.

The meeting then proceeded to a roundtable discussion, moderated by Tim Lord, UK Head of Climate & Energy at HSBC. Representatives from Chinese and UK banks,asset management institutions, and international organizations engaged in a lively discussion, identifying key challenges and potential areas for UK-China collaboration.

Sean Kidney, CEO of the Climate Bonds Initiative, emphasized that successful transition requires close collaboration between governments and the private sector. Public incentives—such as subsidies, R&D investment, and large-scale procurement agreements—are critical to driving market participants’ actions. He noted that China’s policy-driven market approach to energy transition has achieved remarkable results, offering valuable lessons for other countries. He called for strengthening policy guidance and standards, as well as improving data transparency, to direct capital towards hard-to-abate sectors.

Eric Xu Jianhao, Deputy General Manager of China Construction Bank London Branch, reflected on the outcomes of the UK-China Economic and Financial Dialogue (EFD), noting that 29 out of the 69 deliverables were related to green finance, highlighting the depth of bilateral cooperation in this area. He shared that CCB London has issued green bonds in both RMB and USD, as well as the UK’s first blue bond, all of which were oversubscribed. He emphasized that the successful experience in green finance cooperation should serve as a foundation for future collaboration in transition finance, and recommended continuing to leverage the advantages of London as a global financial center to connect bilateral capital flows.

Dr. Dong Shanning, Deputy General Manager, Head Office Finance Department at Bank of Jiangsu, introduced Jiangsu Bank’s transition finance framework, covering scope definition, KPI design, product innovation, and information disclosure. He noted that while local governments are formulating industry decarbonization roadmaps, the lack of unified benchmarks remains a challenge. He expressed interest in learning from the UK’s industry pathway data to refine provincial targets, enabling banks to better align and seize transition opportunities. He suggested that the workstream should prioritize best practice sharing and the exchange of technical tools.

Katherine Han Xiaoyan, Head of ESG Research at Harvest Fund, outlined six key factors for asset managers to advance transition finance: policy consensus, long-term capital, product innovation, corporate capacity building, data infrastructure, and cross-border collaboration. She called for establishing a transition taxonomy for equity markets and enhancing the provision of patient capital by asset owners. Leveraging platforms like the China Climate Engagement Initiative (CCEI), she advocated for promoting investee companies’ climate disclosures, emission reduction practices, and stewardship. She recommended that the UK-China workstream focus on data interoperability and the design of long-term incentive mechanisms to build market confidence and accelerate scaled development.

Andrew Howard, Global Head of Sustainable Investment at Schroders, noted that while capital is ready to flow into low-carbon assets with clear returns, significant barriers remain in policy coordination, permitting processes, and performance measurement. He recommended the development of an outcome-based transition assessment framework, centered on emissions reduction performance, to enhance credibility and guide investment decisions. He also emphasized the role of the public sector in de-risking investments, particularly in emerging markets, to lower financing costs and unlock the investment potential of brown-to-green transitions. Such approaches, he suggested, could offer replicable models for broader UK-China cooperation.

In closing, ZHAO Lijian, Director of IFS and Secretariat Head of the UK-China Transition Finance Workstream, delivered closing remarks. He emphasized that the official launch of the UK-China Transition Finance Workstream marks a significant step forward in advancing transition finance in both countries. He noted that the meeting achieved broad consensus on several key areas—standards alignment, sectoral implementation, and capacity building—demonstrating the strong shared commitment and practical cooperation between the UK and China in promoting transition finance. Zhao stated that the Secretariat will work closely with co-lead institutions and member organizations to further drive progress on standard-setting, financial instrument innovation, and institutional capacity building, so that transition finance can move from concept to practical implementation and large-scale deployment.